In the modern and highly competitive business environment, maintaining strong financial health is crucial. Without effective financial management, even thriving companies can face challenges, such as cash flow problems, unmonitored expenses, and missed growth opportunities. Regardless of whether you’re leading a small enterprise or overseeing a fast-growing business, managing finances properly is not just significant — it’s essential for long-term success.

However, financial management, particularly bookkeeping, often gets sidelined as business owners focus on day-to-day operations and strategic growth. This is where the role of a virtual bookkeeping assistant comes into play. Virtual bookkeeping assistants provide cost-effective, efficient, and reliable financial management, ensuring that your business maintains a clear picture of its financial health without the overhead costs of hiring a full-time, in-house team.

In this guide, we’ll dive deep into how a virtual bookkeeping assistant can transform your financial processes, improve your business’s bottom line, and set the foundation for long-term financial success. Plus, we’ll explore how partnering with Avery Outsourcing, a premier virtual assistant service provider in Singapore, can help you streamline your operations and boost your financial health.

The Evolution of Bookkeeping: From Traditional to Virtual

The world of bookkeeping has dramatically evolved over the past few decades. Traditionally, businesses would hire in-house accountants or bookkeepers who would work onsite, managing financial records with physical ledgers and spreadsheets. While this approach worked well for larger companies with significant budgets, small and medium-sized enterprises (SMEs) often found it difficult to afford the associated costs, which included salaries, benefits, training, and office space.

In the digital age, however, businesses have shifted away from traditional bookkeeping in favor of virtual and remote options. This shift is largely driven by the rise of cloud-based accounting software, which allows businesses to manage their financial records remotely and securely. These systems, combined with the availability of highly skilled virtual assistants, have made it easier for businesses to outsource their bookkeeping needs.

Why Virtual Bookkeeping Is the Future

- Cost Efficiency: Virtual bookkeeping eliminates the need for full-time staff, saving businesses thousands in overhead expenses. Instead, businesses can pay for the services they need, whether it’s hourly, part-time, or full-time assistance.

- Accessibility: With cloud-based bookkeeping software, businesses have 24/7 access to their financial data from anywhere in the world. This not only increases flexibility but also allows business owners to stay informed about their company’s financial health in real time.

- Accuracy and Compliance: Virtual bookkeeping assistants are skilled professionals who stay up to date on the latest financial regulations and best practices, ensuring that your business remains compliant with local and international financial standards.

What is a Virtual Bookkeeping Assistant?

A virtual bookkeeping assistant is a remote professional who manages your business’s financial records, ensuring that your books are accurate, up to date, and compliant with relevant regulations. Unlike traditional bookkeepers who work onsite, virtual assistants operate remotely, using cloud-based software to manage your financial data.

Virtual bookkeeping assistants perform a wide range of tasks, including:

- Recording financial transactions: Ensuring that all income and expenses are accurately recorded.

- Managing accounts receivable and payable: Keeping track of invoices, ensuring that they are sent on time and payments are collected promptly.

- Bank reconciliations: Ensuring that your bank statements align with your internal financial records.

- Preparing financial reports: Generating monthly, quarterly, and annual reports that provide insights into your business’s financial performance.

Virtual assistants use advanced bookkeeping software, such as QuickBooks, Xero, and FreshBooks, to manage your financial data efficiently and securely. These tools allow them to work in real-time, providing business owners with up-to-date insights into their financial status.

Why Virtual Bookkeeping Assistants Are Essential for SMEs

For small and medium-sized businesses, the cost of hiring a full-time bookkeeper can be prohibitive. Virtual bookkeeping assistants offer a cost-effective alternative, allowing businesses to access expert financial management without the need for a full-time employee. This is particularly beneficial for startups and SMEs, which often operate on tight budgets.

In addition, virtual assistants can easily scale their services to match the needs of your business. Whether you require additional support during peak periods (such as tax season) or reduced services during slower times, virtual bookkeeping assistants offer the flexibility to adjust their workload based on your company’s requirements.

Key Benefits of Hiring a Virtual Bookkeeping Assistant

Cost Savings

The financial benefits of hiring a virtual bookkeeping assistant are substantial. Traditional in-house bookkeepers require salaries, benefits, training, and office space, all of which add to the cost of doing business. By contrast, virtual assistants operate remotely, eliminating the need for office space and equipment. You only pay for the services you need, whether it’s a few hours a week or full-time support during busy periods.

For small businesses, in particular, these cost savings can be a game-changer. By outsourcing bookkeeping tasks to a virtual assistant, business owners can allocate more resources to growing their business, investing in new products, or expanding their marketing efforts.

Flexibility and Scalability

As your business grows, so too do your bookkeeping needs. A virtual bookkeeping assistant offers the flexibility to scale their services up or down depending on the demands of your business. For example, during tax season, you may need additional support to ensure that all financial records are accurate and compliant. Alternatively, during slower periods, you can reduce the number of hours your virtual assistant works.

This flexibility is particularly beneficial for businesses that experience seasonal fluctuations in demand. Rather than hiring additional staff to manage increased workloads, you can rely on your virtual assistant to provide the necessary support.

Increased Efficiency and Accuracy

One of the primary advantages of virtual bookkeeping is the use of automation and cloud-based tools, which streamline many of the manual processes associated with traditional bookkeeping. By using these tools, virtual bookkeeping assistants can complete tasks more efficiently and with greater accuracy. In addition, these tools allow for real-time updates, ensuring that your financial records are always up to date.

For example, virtual assistants can automate the process of sending invoices, tracking payments, and reconciling bank statements, reducing the likelihood of human error. This not only saves time but also improves the accuracy of your financial records, giving you peace of mind that your books are in good hands.

How a Virtual Bookkeeping Assistant Improves Your Financial Health

Accurate Financial Record Keeping

Maintaining accurate financial records is essential for making informed decisions about the future of your business. Without accurate data, it’s impossible to know whether your business is profitable, where your money is going, or how much you owe in taxes. A virtual bookkeeping assistant ensures that your financial records are meticulously maintained, giving you a clear and accurate view of your company’s finances.

Accurate record-keeping is also crucial for tax compliance. Virtual assistants can help you stay organized throughout the year, ensuring that you have all the necessary documentation when it’s time to file your taxes. This can prevent costly errors, such as overpaying or underpaying your taxes, and reduce the risk of audits.

Better Cash Flow Management

Effective cash flow management is critical to the success of any business. Cash flow refers to the movement of money in and out of your business, and it’s essential for covering day-to-day expenses, such as payroll, rent, and utilities. A virtual bookkeeping assistant can help you manage your cash flow by tracking accounts receivable and payable, ensuring that invoices are sent out promptly, and following up on overdue payments.

In addition, virtual assistants can help you identify trends in your cash flow, allowing you to make more informed decisions about when to invest in new equipment, hire additional staff, or expand your operations.

Budget Planning and Financial Forecasting

Budgeting is an essential part of financial planning, as it allows you to allocate resources effectively and plan for future growth. A virtual bookkeeping assistant can help you create and maintain a budget, ensuring that your business stays on track financially. By analyzing your income and expenses, your virtual assistant can provide insights into where your money is going and recommend strategies for reducing costs.

In addition to budgeting, virtual assistants can assist with financial forecasting, which involves predicting your business’s future financial performance based on historical data. This allows you to anticipate potential challenges, such as cash flow shortages or increased expenses, and develop strategies to mitigate these risks.

Choosing the Right Virtual Bookkeeping Assistant for Your Business

When selecting a virtual bookkeeping assistant, it’s essential to consider their qualifications, skills, and experience. Look for a virtual assistant who has a background in bookkeeping, accounting, or financial management. They should be proficient in the bookkeeping software you use (such as QuickBooks, Xero, or FreshBooks) and have excellent organizational and communication skills.

In addition, it’s important to ensure that your virtual assistant is trustworthy and reliable, as they will be handling sensitive financial data. Make sure that confidentiality agreements are in place and that your virtual assistant has a track record of maintaining the highest levels of professionalism and discretion.

Virtual Bookkeeping Assistants and Tax Compliance

One of the most critical aspects of managing a business’s finances is staying compliant with tax regulations. Filing taxes can be a complex and overwhelming process, especially for small businesses that may not have in-house financial expertise. Mistakes in tax filings can lead to penalties, fines, or even audits, all of which can significantly impact your business’s bottom line.

A virtual bookkeeping assistant can play a pivotal role in ensuring that your business remains compliant with tax laws. They can manage all aspects of tax preparation, including:

- Tracking income and expenses: Virtual assistants will ensure that all financial transactions are properly categorized and documented, which is crucial when filing taxes.

- Tax filing reminders: A virtual assistant can set up reminders for important tax deadlines, ensuring you never miss critical dates for filing your returns.

- Preparing tax reports: Virtual bookkeeping assistants can generate detailed financial reports, giving you a clear overview of your tax liabilities and deductions.

- Collaborating with accountants: In some cases, virtual assistants will collaborate with accountants or tax advisors to ensure that your business is taking advantage of all available tax deductions and credits.

Cloud-Based Bookkeeping Software: A Key Tool for Virtual Assistants

Cloud-based bookkeeping software has become an indispensable tool for businesses and virtual bookkeeping assistants alike. These platforms provide secure, real-time access to financial data, enabling both business owners and virtual assistants to manage finances more effectively.

Popular cloud-based accounting platforms include:

- QuickBooks Online: One of the most widely used bookkeeping platforms, QuickBooks offers features such as automated invoicing, expense tracking, and financial reporting.

- Xero: Known for its user-friendly interface, Xero is ideal for businesses of all sizes, providing tools for bank reconciliations, inventory management, and payroll processing.

- FreshBooks: A favorite among freelancers and small businesses, FreshBooks simplifies invoicing and expense tracking with intuitive design and easy-to-use features.

Benefits of Using Cloud-Based Software for Bookkeeping

- Real-time collaboration: Cloud-based software allows virtual assistants and business owners to access the same financial data in real-time, ensuring that everyone is on the same page.

- Automation: Many of these platforms include automated features such as recurring invoicing, payment reminders, and bank reconciliations, which can significantly reduce the time spent on manual data entry.

- Data security: These platforms use advanced encryption technologies to protect your financial data, ensuring that sensitive information remains secure.

- Access anywhere: Cloud-based systems allow virtual assistants and business owners to access financial records from anywhere, providing flexibility for remote work and business travel.

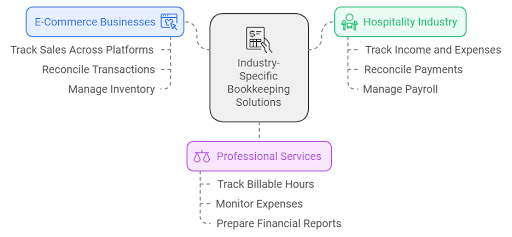

Industry-Specific Bookkeeping Solutions for Different Business Sectors

Different industries have unique bookkeeping needs, and a one-size-fits-all approach may not always be effective. Virtual bookkeeping assistants can provide industry-specific solutions tailored to the unique requirements of your business sector. Here’s how virtual assistants can benefit different industries:

1. E-Commerce Businesses

Managing finances in e-commerce can be complex due to the high volume of transactions, fluctuating inventory levels, and sales across multiple platforms. Virtual bookkeeping assistants can:

- Track sales across platforms like Shopify, Amazon, and eBay.

- Reconcile transactions from multiple payment gateways (e.g., PayPal, Stripe).

- Manage inventory and calculate the cost of goods sold (COGS).

2. Hospitality Industry

The hospitality sector deals with daily sales, reservations, and event bookings, making accurate bookkeeping essential. Virtual assistants in this sector can:

- Track income and expenses across multiple revenue streams, including lodging, food services, and events.

- Reconcile payments from point-of-sale (POS) systems.

- Manage payroll and tips distribution for staff.

3. Professional Services (Lawyers, Consultants, Freelancers)

For businesses offering professional services, accurate time tracking and billing are crucial. Virtual bookkeeping assistants can:

- Track billable hours and generate invoices for clients.

- Monitor expenses related to project management or service delivery.

- Prepare financial reports that help professionals understand profitability and cash flow.

How Virtual Assistants Help with Financial Decision-Making

In addition to managing daily bookkeeping tasks, virtual bookkeeping assistants can also provide critical support in the decision-making process. Accurate financial data is essential when making strategic business decisions, and virtual assistants can ensure that you always have access to the latest financial reports and insights.

1. Cash Flow Analysis

Understanding cash flow is essential for making informed decisions about business expansion, marketing budgets, and resource allocation. Virtual assistants can track your cash inflows and outflows, providing you with detailed reports that show trends in your cash flow. With this information, you can make decisions about when to invest in new opportunities or when to hold back on spending.

2. Financial Forecasting

Financial forecasting involves predicting future revenue, expenses, and profitability based on historical data. Virtual bookkeeping assistants can help generate financial forecasts that allow you to anticipate potential challenges or opportunities. These forecasts can be critical when deciding whether to launch new products, enter new markets, or hire additional staff.

3. Budget Planning

A well-structured budget is the foundation for any successful business. Virtual assistants can assist with the creation and maintenance of budgets, helping you allocate resources effectively. With accurate budgeting, you can avoid overspending and ensure that your business remains on track for financial success.

Why Avery Outsourcing – Virtual Assistant Services is Your Ideal Partner

A Leading Name in Virtual Assistant Services in Singapore

Avery Outsourcing has earned a reputation as a trusted provider of virtual assistant services in Singapore, offering tailored solutions for businesses of all sizes. With years of experience in the industry, Avery specializes in helping businesses improve their financial health by providing expert virtual bookkeeping assistants who are trained to manage complex financial tasks with accuracy and efficiency.

Tailored Virtual Bookkeeping Solutions for Your Business

Avery Outsourcing offers customized virtual bookkeeping services that are designed to meet the unique needs of your business. Whether you need part-time bookkeeping support or full-time financial management, Catalyst’s virtual assistants are equipped with the skills and expertise necessary to keep your finances in order. Their services are flexible, scalable, and designed to grow with your business.

Trusted Professionals with Global Reach

Avery Outsourcing employs highly trained professionals who have extensive experience working with businesses across a range of industries. Each virtual assistant undergoes rigorous training to ensure that they are up to date on the latest financial regulations and bookkeeping practices. With Catalyst’s global reach, businesses in Singapore and beyond can benefit from their cost-effective, reliable services.

How Avery Outsourcing Can Improve Your Business’s Financial Health

Partnering with Avery Outsourcing can have a profound impact on your business’s financial health. Their team of experienced virtual assistants can help you:

- Maintain accurate financial records, ensuring that your books are always up to date.

- Improve cash flow management by tracking accounts receivable and payable, ensuring that payments are collected on time.

- Develop realistic budgets and financial forecasts that guide your business toward sustainable growth.

- Ensure compliance with tax regulations and reduce the risk of financial penalties.

Avery Outsourcing’s services are designed to help businesses of all sizes stay financially healthy and grow sustainably. Whether you need a virtual assistant for a specific project or ongoing financial management, Avery has the expertise to support your business every step of the way.

The Future of Virtual Bookkeeping

As technology continues to advance, the role of virtual bookkeeping assistants is evolving. New tools and technologies are transforming how businesses manage their finances, making bookkeeping more efficient and accessible than ever before.

1. Artificial Intelligence (AI) in Bookkeeping

AI is revolutionizing the bookkeeping industry by automating routine tasks such as data entry, invoice processing, and bank reconciliations. Virtual assistants can now use AI-powered software to analyze financial data, identify patterns, and generate insights that help businesses make better decisions.

For example, AI can automatically categorize transactions based on historical data, making it easier for virtual assistants to maintain accurate records without manual intervention. This not only saves time but also reduces the risk of human error.

2. Blockchain Technology

Blockchain is another emerging technology that has the potential to transform bookkeeping. Blockchain provides a secure and transparent way to record financial transactions, ensuring that data is immutable and easily traceable. Virtual assistants can use blockchain technology to maintain accurate, tamper-proof financial records that can be verified by all parties involved.

3. Advanced Data Analytics

As businesses generate more data, the ability to analyze and interpret this data becomes increasingly important. Virtual assistants can use advanced data analytics tools to provide deeper insights into financial performance, helping businesses identify trends, uncover inefficiencies, and make more informed decisions.

With these technological advancements, the role of virtual bookkeeping assistants is becoming more strategic. Rather than simply managing transactions, virtual assistants are now equipped to provide higher-level insights and support, helping businesses navigate complex financial landscapes.

Ensuring Data Security in Virtual Bookkeeping

In an era where data breaches and cyberattacks are becoming more common, protecting your business’s financial data is more important than ever. When working with a virtual bookkeeping assistant, it’s essential to ensure that they follow best practices for data security to keep your financial information safe.

1. Using Secure Cloud Platforms

Cloud-based bookkeeping software provides advanced encryption technologies that protect your financial data from unauthorized access. Virtual assistants should only use secure, trusted platforms that offer two-factor authentication and regular software updates to ensure the highest level of security.

2. Implementing Access Controls

To further safeguard your financial data, it’s important to limit who has access to sensitive information. Virtual assistants should work with business owners to set up access controls, ensuring that only authorized individuals can view or edit financial records.

3. Data Backup and Recovery Plans

Even with the best security measures in place, data loss can still occur due to hardware failures or software malfunctions. Virtual bookkeeping assistants should implement regular data backups and have a recovery plan in place to ensure that your financial data can be restored in the event of an emergency.

Start Your Financial Transformation with Avery Outsourcing Now!

Are you ready to take control of your financial health and streamline your bookkeeping processes? Avery Outsourcing’s virtual assistant services can help you achieve your financial goals, improve cash flow management, and develop better financial strategies for long-term success. Contact Avery Outsourcing today to learn more about how their expert virtual assistants can improve your business’s financial health and help you grow sustainably.